How to Maximize Your Refund with an Online Tax Return in Australia This Year

How to Maximize Your Refund with an Online Tax Return in Australia This Year

Blog Article

Simplify Your Funds: How to File Your Online Tax Obligation Return in Australia

Declaring your on-line tax obligation return in Australia need not be a daunting task if come close to carefully. Recognizing the details of the tax obligation system and appropriately preparing your records are important very first steps.

Understanding the Tax System

To browse the Australian tax obligation system successfully, it is important to comprehend its essential principles and framework. The Australian tax obligation system operates a self-assessment basis, implying taxpayers are accountable for properly reporting their earnings and calculating their tax commitments. The primary tax authority, the Australian Taxation Workplace (ATO), manages compliance and enforces tax obligation legislations.

The tax system comprises numerous elements, including revenue tax obligation, products and services tax (GST), and capital gains tax obligation (CGT), to name a few. Specific income tax obligation is progressive, with prices boosting as income increases, while corporate tax obligation rates vary for little and large organizations. Furthermore, tax obligation offsets and deductions are readily available to minimize gross income, permitting more tailored tax obligation obligations based upon individual circumstances.

Knowledge tax obligation residency is additionally vital, as it establishes a person's tax responsibilities. Homeowners are exhausted on their around the world earnings, while non-residents are just taxed on Australian-sourced income. Knowledge with these concepts will certainly empower taxpayers to make educated choices, ensuring conformity and possibly maximizing their tax obligation outcomes as they prepare to submit their on the internet tax obligation returns.

Preparing Your Papers

Gathering the needed documents is a critical action in preparing to file your on the internet tax obligation return in Australia. Correct documentation not only enhances the declaring process however additionally ensures accuracy, reducing the danger of mistakes that might bring about penalties or delays.

Begin by gathering your earnings statements, such as your PAYG repayment recaps from companies, which information your revenues and tax obligation held back. online tax return in Australia. Ensure you have your business income records and any relevant billings if you are independent. Additionally, gather bank declarations and documents for any passion made

Next, assemble documents of insurance deductible expenses. This may consist of invoices for job-related costs, such as uniforms, travel, and devices, in addition to any type of educational costs associated with your profession. Guarantee you have documentation for rental revenue and connected expenses like fixings or building administration fees. if you have home.

Do not fail to remember to include various other relevant records, such as your health and wellness insurance information, superannuation contributions, and any kind of financial investment income statements. By meticulously arranging these files, you establish a solid foundation for a smooth and effective on-line tax return process.

Picking an Online Platform

After organizing your documents, the following step involves picking a proper online platform for submitting your tax obligation return. online tax return in Australia. In Australia, several credible systems are available, each offering distinct functions tailored to various taxpayer needs

When picking an on the internet system, consider the customer interface and ease of navigating. A straightforward design can dramatically boost your experience, making it simpler to input your details accurately. Furthermore, ensure the platform is certified with the Australian Taxation Office (ATO) laws, as this will guarantee that your submission fulfills all lawful requirements.

One more important factor is the availability of client support. Systems supplying real-time chat, phone support, or extensive Frequently asked questions can give beneficial assistance if you experience difficulties throughout the declaring procedure. Examine the safety actions in area to protect your individual details. Look for platforms that make use of encryption and have a strong personal privacy plan.

Lastly, consider the prices linked with numerous platforms. While some may supply cost-free solutions for basic income tax return, others might charge fees for advanced attributes or extra support. Weigh these variables to pick the platform that aligns best with your economic circumstance and filing needs.

Step-by-Step Declaring Process

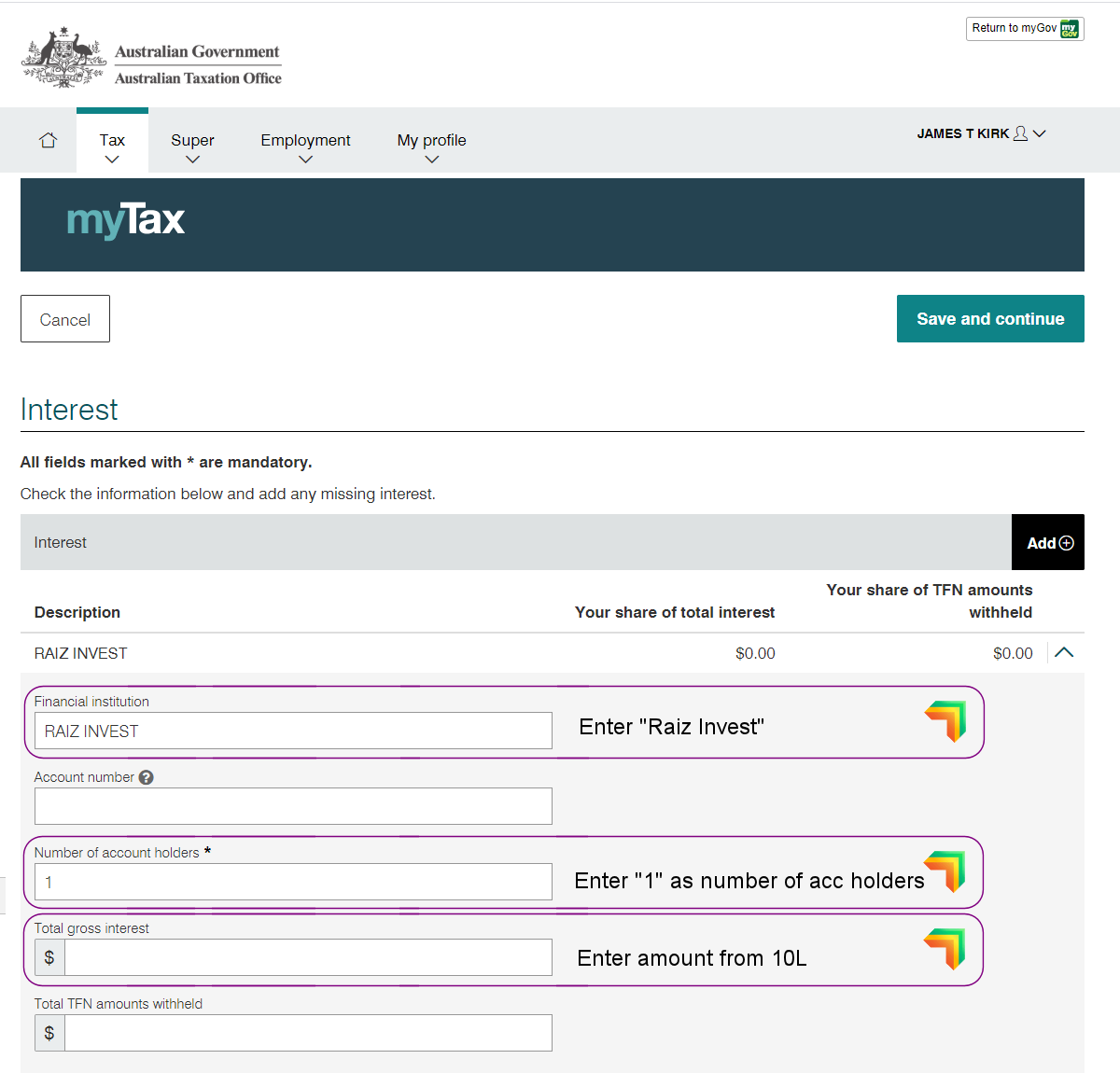

The step-by-step filing procedure for your online income tax return in Australia is designed to improve the entry of your monetary details while making sure compliance with ATO guidelines. Begin by gathering all necessary records, including your earnings declarations, bank declarations, and any type of invoices for reductions.

Once you have your papers ready, visit to your chosen online platform and develop or access your account. Input your personal information, including your Tax Data Number (TFN) and contact info. Following, enter your income information accurately, making sure to consist of all income sources such as salaries, rental earnings, or financial investment profits.

After describing your income, move on to assert eligible deductions. This might include job-related expenses, charitable contributions, and medical expenditures. Make sure to review the ATO standards to maximize your claims.

When all information is gone into, carefully evaluate your return for precision, fixing any type of disparities. After guaranteeing every little thing is appropriate, send your income tax return electronically. You will certainly obtain a confirmation of submission; click reference maintain this for your documents. Monitor your account for any kind of updates from the ATO regarding your tax obligation return condition.

Tips for a Smooth Experience

Completing your on the internet income tax return can be a straightforward process with the right preparation and mindset. To ensure a smooth experience, begin by collecting all necessary papers, such as your earnings declarations, receipts for reductions, and any other pertinent monetary records. This company minimizes mistakes and conserves time during the declaring procedure.

Next, familiarize on your own with the Australian Tax Office (ATO) internet site and its on the internet services. Make use of the ATO's resources, including overviews and FAQs, to clarify any kind of uncertainties prior to you start. online tax return in Australia. Consider establishing a MyGov account linked to the ATO for a structured filing experience

Additionally, make the most of the pre-fill capability provided by the ATO, which instantly occupies some of your info, decreasing the opportunity of mistakes. Guarantee you double-check all access for accuracy before entry.

Lastly, enable on your own enough time to finish the return without feeling rushed. This will certainly help you preserve emphasis and decrease anxiousness. If problems emerge, don't wait to seek advice from a tax obligation expert or make use of the ATO's assistance services. Complying with these pointers can result in a successful and convenient on-line income tax return experience.

Final Thought

In final thought, filing an online tax obligation return in Australia can be structured with cautious preparation and selection of ideal sources. Inevitably, these techniques add to an extra effective tax declaring experience, streamlining financial management and enhancing compliance with tax obligation responsibilities.

Report this page